Social Security’s Cost-of-Living Adjustment (COLA) is an annual increase in benefits designed to help retirees and disabled Americans keep pace with inflation. This yearly adjustment is necessary because it aims to preserve the buying power of monthly checks, especially when prices rise for everyday goods and services. The COLA for 2026 was set at 2.8%, reflecting moderate inflation trends.

Recent actions by the Federal Reserve, including multiple interest rate cuts in 2025, have sparked discussion about how future COLAs might be influenced. While COLAs are calculated based on inflation data, not directly on Federal Reserve interest rate decisions, changes in rates can affect economic conditions and inflation expectations.

Table of Contents

What Social Security COLA Means

Social Security COLA is an automatic annual increase applied to benefits to help protect purchasing power. The Social Security Administration uses inflation data to decide whether benefits should rise and by how much.

The adjustment is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers, also known as CPI-W. This index tracks changes in prices for common goods and services paid by working households.

If inflation rises during the measurement period, Social Security benefits increase. If inflation is flat or negative, benefits may remain the same, as happened in some past years.

COLA applies to retirement benefits, disability benefits, survivor benefits, and Supplemental Security Income payments.

How COLA Is Calculated Each Year

The Social Security Administration compares CPI-W data from the third quarter of the current year to the third quarter of the previous year. The difference between these two periods determines the COLA percentage.

If prices are higher in the newer period, beneficiaries receive a COLA increase starting in January of the following year. If prices do not increase, no COLA is applied.

This process is automatic and does not require congressional approval. Once the inflation data is finalized, the adjustment is announced publicly.

For 2026, this formula resulted in a confirmed COLA increase of 2.8%.

Federal Reserve Rate Cuts Explained

The Federal Reserve controls interest rates to manage inflation and economic growth. When inflation slows or economic activity weakens, the Fed may lower interest rates to encourage borrowing and spending.

In 2025, the Federal Reserve reduced its benchmark interest rate multiple times. By December 2025, the federal funds rate was lowered to a range of 3.5% to 3.75%.

Lower interest rates can influence consumer behavior, business investment, and overall economic demand. Over time, these changes can affect inflation levels, which are closely monitored for Social Security COLA calculations.

However, the Federal Reserve does not directly influence Social Security payments or COLA decisions.

Connection Between Fed Rate Cuts and Social Security COLA

Social Security COLA is not tied to Federal Reserve policy decisions. Instead, it relies solely on measured inflation using CPI-W data.

That said, Federal Reserve rate cuts can indirectly influence inflation trends. Lower rates may lead to increased spending, which can raise prices for goods and services over time.

If inflation rises due to economic conditions influenced by rate cuts, future COLA adjustments may increase. If inflation remains controlled or declines, COLA increases may be smaller.

This indirect relationship explains why Federal Reserve actions are often discussed alongside Social Security benefit forecasts.

Current COLA Status for 2026

The COLA for 2026 has already been finalized and will not change, regardless of future Federal Reserve actions.

Facts about the 2026 COLA include:

- The COLA rate is 2.8%

- Payments reflecting this increase begin in January 2026

- The adjustment applies to Social Security retirement, disability, survivor benefits, and SSI

- Nearly 71 million beneficiaries are affected

This increase reflects moderate inflation during the CPI-W measurement period used by the Social Security Administration.

Impact of Inflation on Benefit Value

Even with annual COLA increases, beneficiaries may experience reduced purchasing power if certain costs rise faster than inflation averages.

Healthcare costs, prescription drugs, housing, and insurance premiums often increase at rates that exceed CPI-W measurements. As a result, the real value of COLA increases can feel limited for many recipients.

Medicare Part B premiums, which are typically deducted from Social Security payments, may also rise. When this happens, the net benefit increase received by beneficiaries can be smaller than the announced COLA percentage.

These factors make inflation measurement especially important for understanding how COLA affects real household budgets.

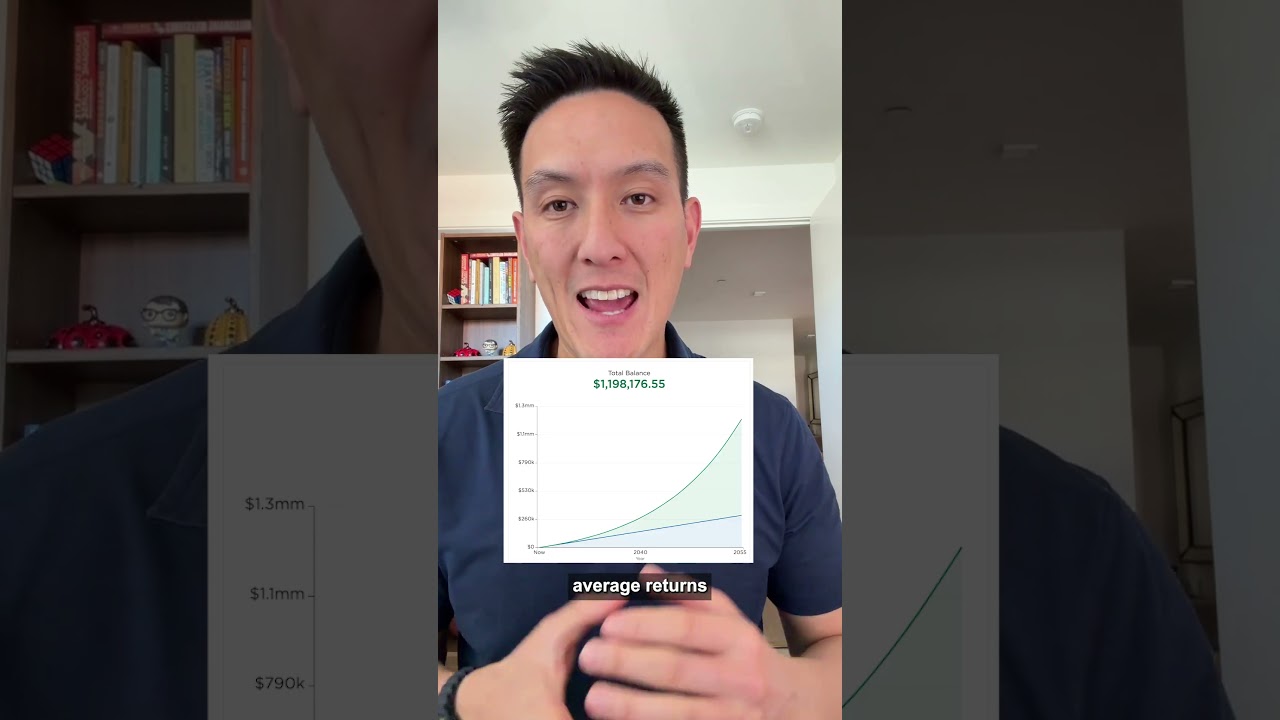

Outlook for Future COLA Adjustments

While the 2026 COLA is fixed, attention has shifted to future adjustments, particularly for 2027.

Based on current inflation trends and economic data, early projections suggest the 2027 COLA may be lower than recent increases. Analysts estimate it could fall in the 2.3% to 2.6% range, depending on upcoming CPI-W data.

These projections remain subject to change, as inflation levels can shift due to economic conditions, energy prices, and consumer demand.

Final COLA announcements are typically made in October, once the required inflation data is finalized.

Factors That Influence Future COLA Amounts

Only a limited number of measurable factors determine future COLA increases:

- CPI-W inflation data from July through September

- Price changes in essential goods and services

- Broader economic conditions affecting consumer costs

- No direct role of Federal Reserve interest rate decisions

Understanding these factors helps beneficiaries follow COLA developments without confusion from unrelated economic headlines.

Why COLA Matters for Long-Term Financial Planning

Social Security remains a primary income source for millions of Americans. COLA adjustments help ensure that benefits do not lose value entirely due to inflation.

However, COLA is designed to offset average inflation, not individual household expenses. This means beneficiaries should stay informed about benefit changes and inflation trends each year.

Tracking COLA announcements, Medicare premium updates, and inflation data can help beneficiaries better understand changes in their monthly income.